Hospitality Labour Costs in Ireland 2026: Regulations, Pressures & Smarter Workforce Control

The 2026 Labour Cost Landscape in Ireland

Hospitality operators in Ireland are entering 2026 under sustained cost pressure.

Several regulatory and structural changes are reshaping labour economics:

1️⃣ National Minimum Wage Increase

As of 1 January 2026, Ireland’s National Minimum Wage has increased (aligned with the Living Wage transition roadmap). For hospitality businesses where many roles sit near minimum wage, even small hourly adjustments have material impact across large teams.

(Source: Department of Enterprise, Trade and Employment – Minimum Wage Updates)

2️⃣ Automatic Enrolment Pension

Ireland’s long-awaited Auto-Enrolment Retirement Savings Scheme is scheduled to roll out in 2026. While this primarily applies to employees (not genuine contractors), it increases long-term payroll obligations for traditional employment models.

(Source: Department of Social Protection – Auto Enrolment Pension Scheme)

3️⃣ Ongoing Contractor Classification Scrutiny

Following the Karshan / Domino’s decision, Revenue has increased scrutiny around worker classification and reinforced the message:

| What matters is not what the contract says but what actually happens in practice

For hospitality operators using flexible labour, documentation and operational clarity now matter more than ever.

(Source: Revenue eBrief & Government Guidance following the Karshan ruling)

4️⃣ Operational Pressures Remain

Industry submissions continue to flag:

- Staffing instability

- Accommodation constraints

- Margin pressure despite VAT adjustments

- Rising payroll administration burden

For operators, this isn’t theoretical. It’s daily reality.

(Source: Irish Hotels Federation (IHF) budget 2026 submission)

What Rising Labour Costs Really Mean for Hospitality Operators

When labour costs increase, most operators instinctively ask:

- Should we cut hours?

- Should we reduce headcount?

- Should we absorb the cost?

- Should we increase prices?

But in practice, the bigger issue is usually:

Wasted or uncontrolled labour spend.

Examples include:

- Paying for downtime between peaks

- Over-scheduling “just in case”

- Manual rota adjustments

- Reconstructing payroll records after the fact

- Running freelancers in one system and staff in another

In 2026, labour cost control is less about wage rates and more about operational precision.

The Compliance Layer: Why It Now Intersects with Cost

Revenue’s current approach reinforces one core principle:

Substance over contract wording.

Employment status is assessed using a five-point framework and decision tree, based on the real working relationship.

The key considerations include:

- Control over how, when and where work is carried out

- Requirement for personal service

- Integration into the business

- Mutuality of obligation

- Provision of equipment and financial risk

If day-to-day operations resemble employment, risk increases regardless of contract labels.

This is why evidence matters.

Not opinion.

Not paperwork alone.

But clear, consistent records showing how work is actually performed.

And this is where cost and compliance now intersect:

Poor records don’t just create compliance risk.

They create administrative cost, stress, and disruption.

A Smarter 2026 Strategy: Control Labour by Design

The strongest operators in 2026 are not reacting to wage increases.

They are:

- Tightening shift-level cost visibility

- Linking payroll directly to verified hours

- Reducing paid downtime

- Consolidating workforce systems

- Embedding compliance into everyday operations

This is not about cutting corners.

It’s about building labour control into the operating model.

Practical Labour Cost Control in Hospitality

Here are the highest-impact adjustments operators are making:

1️⃣ Shift-Level Visibility

Knowing exactly:

- Who worked

- When they worked

- How long they worked

- What they were paid

Without reconstructing from messages or spreadsheets.

2️⃣ Reducing Paid Downtime

Aligning shift start/end times more precisely with demand peaks.

Avoiding blanket overstaffing.

3️⃣ Flexible Workforce Mix

Using genuine contractors appropriately without misclassification risk to match demand variability.

4️⃣ System Consolidation

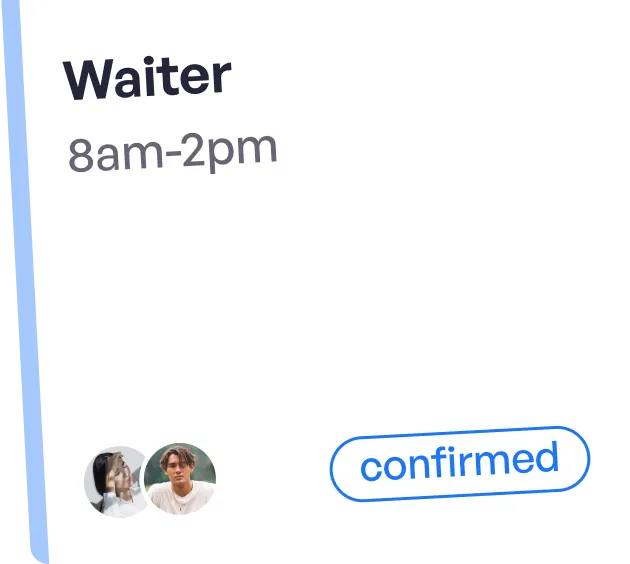

Managing in-house staff and freelancers in one operational system, instead of running parallel processes.

5️⃣ Built-In Compliance Evidence

Ensuring shift logs, attendance and payroll trails are created automatically so compliance isn’t a separate project.

Where Gigable Fits in This 2026 Landscape

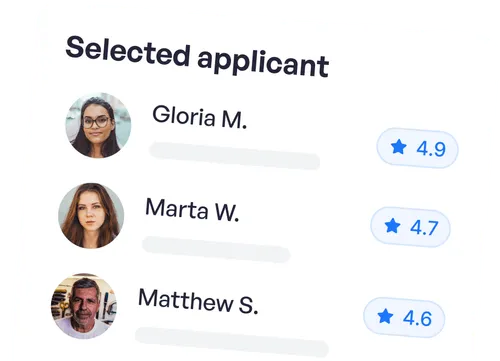

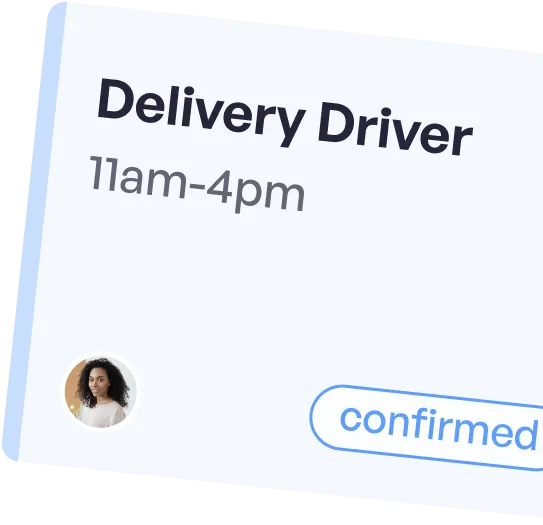

Gigable CMS supports hospitality businesses operationally — not by giving legal advice, but by embedding compliance and cost control into daily workforce management.

Gigable helps businesses:

- Manage freelancers and in-house teams in one platform (Team feature)

- Track shifts and attendance automatically

- Link payroll clearly to verified work completed

- Maintain audit-ready records as work happens

- Receive dedicated account manager support for operational changes

The result?

- Fewer wasted labour hours

- Cleaner payroll trails

- Greater control per shift

- Reduced admin burden

- Stronger compliance confidence

In a year defined by rising labour costs and tighter scrutiny, workforce control is no longer optional. It’s strategic.

Final Thought: 2026 Is Not Just About Higher Costs

It’s about higher expectations.

Higher documentation standards.

Higher scrutiny.

Higher financial sensitivity per shift.

Hospitality leaders who build compliance and cost control into operations from day one will carry those gains long beyond 2026.

If you’re reviewing how labour is managed this year, it may be time to move from reactive fixes to structured control and explore how Gigable CMS (Contractor Management Software) supports hospitality teams today.

Try Gigable today

Take the next step and join Gigable today. Let's put those insights into action and boost your business or freelance career!

More articles

Holiday Staffing Made Easy: Gigable’s Win-Win Approach to Compliance & Contractor Retention